Comprehending the Fundamentals of Money Exchange in Today's Global Market

In a progressively interconnected international economy, comprehending the principles of money exchange is essential for stakeholders across numerous sectors. As central banks put in impact and technical developments reshape currency trading, the ramifications for international business are far-ranging.

The Basics of Currency Exchange

Currency exchange is an essential facet of the international economy, assisting in global profession and financial investment. It entails the conversion of one money right into an additional and is crucial for businesses, governments, and individuals that take part in cross-border transactions. The currency exchange procedure occurs in the fx market (Foreign exchange), which is the biggest and most fluid monetary market on the planet, operating 24 hr a day, five days a week.

At its core, currency exchange is driven by supply and need characteristics. Currencies are traded in pairs, such as EUR/USD or GBP/JPY, and the exchange rate between them indicates how much one money deserves in terms of one more. This rate fluctuates continuously due to trade flows, funding movements, and various other market tasks.

Participants in the Foreign exchange market range from huge banks and multinational firms to specific capitalists and visitors. Each individual may have various goals, such as hedging versus currency exchange rate danger, guessing on currency movements, or assisting in international purchases. Comprehending the essentials of currency exchange is essential for making notified choices in the international market, as exchange rates can substantially influence the expense of goods and solutions, financial investment returns, and economic security.

Elements Influencing Exchange Rates

Greater passion prices provide lending institutions far better returns family member to other countries, attracting more international funding and causing the money to appreciate. Conversely, rising cost of living rates play an important role; currencies in nations with reduced inflation prices have a tendency to appreciate as purchasing power rises loved one to higher-inflation economies.

Economic development and security likewise substantially impact currency exchange rate. A robust economy attracts international investment, increasing demand for the residential currency, which leads to admiration. Furthermore, profession balances impact currency value. A country with a considerable trade surplus typically sees its money value because of increased foreign need for its goods and services, while a profession deficit can deteriorate the money.

Political security and economic performance are essential too; countries perceived as low-risk locations for investment often tend to see their money value. forex trading course. Market supposition can additionally drive currency exchange rate variations, as investors anticipate future movements based on existing financial indicators and geopolitical occasions. These aspects collectively add to the vibrant nature of exchange rates in the global market

The Function of Central Financial Institutions

Main banks also involve in foreign exchange treatments to fix too much volatility or misalignments in currency exchange rate. These interventions may involve purchasing or selling international currencies to keep a preferred currency exchange rate level. In addition, reserve banks hold considerable forex books, which can be released strategically to sustain their money.

Innovation and Currency Trading

While reserve banks form the overarching landscape of currency exchange, technological developments have transformed the mechanics of money trading itself. The proliferation of electronic systems has democratized access to forex markets, making it possible for specific investors to take part alongside institutional investors. On-line trading systems, outfitted with real-time information and analytical devices, promote notified decision-making and have added to increased market liquidity.

Algorithmic trading, powered by advanced software, has actually transformed the speed and performance of currency trading. Algorithms implement trades based upon predefined standards, lessening human intervention and reducing the moment required to exploit on market movements. This automation boosts accuracy in profession execution and help in the administration of complex trading you can try this out approaches. Furthermore, the rise of expert system and artificial intelligence formulas provides anticipating analytics, allowing investors to anticipate market patterns with better precision.

Blockchain innovation likewise promises a transformative influence on money trading. By ensuring openness and decreasing deal prices, blockchain can streamline settlement processes, potentially mitigating threats connected with traditional trading techniques. Cryptocurrencies, underpinned by blockchain, have actually presented a brand-new measurement to money trading, triggering market participants to adjust to a progressing economic ecological community. As modern technology remains to evolve, its impact on money trading will likely grow, forming future market characteristics.

Influences on Global Profession

In the interconnected landscape of worldwide trade, money exchange plays a crucial duty in forming economic relationships in between countries. Currency exchange rate influence the price of exporting items and solutions, influencing competitive positioning in global markets. A strong currency can make a country's exports a lot more costly and less attractive on company website the international stage, potentially reducing market share. Conversely, a weak currency can boost export competitiveness yet might boost the cost of importing essential products, impacting profession balance.

Money fluctuations can likewise result in financial uncertainties, making complex long-term planning for international corporations. Organizations usually hedge against these dangers with economic instruments to support costs and profits. Exchange rates influence foreign direct investment (FDI) decisions, as financiers seek positive conditions to make best use of returns, impacting capital flows across boundaries.

Moreover, governments aim to keep secure currency exchange rate to foster foreseeable trading problems, often interfering in foreign exchange markets to accomplish economic objectives. Main banks might readjust rates of interest or execute monetary policies to influence currency toughness, therefore influencing profession dynamics.

Final Thought

A detailed grip of currency exchange basics is necessary for navigating the complexities of the global market. Exchange prices, formed by interest prices, rising cost of living, and economic growth, are pivotal in establishing currency assessments.

Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Luke Perry Then & Now!

Luke Perry Then & Now! Ralph Macchio Then & Now!

Ralph Macchio Then & Now! David Faustino Then & Now!

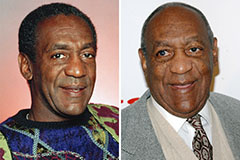

David Faustino Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!